We now know from previous discussions that, China has built a massive war chest of foreign currency reserves in order to keep its currency pegged at an artificial low rate. For this, China absorbs the excess dollars in the system and prints Yuan to match that amount. So it keeps on accumulating dollars and over a decade China has accumulated the biggest dollar reserve equal to over $3 trillion and about 1/3 the total dollar reserves in the world! This is just staggering!!

Idle cash yields nothing! Its better invested. But this is no individual's money. This belongs to China and hence has to be invested in the safest asset available in the world. Until lately, US government bonds (Treasury bills, notes and bonds) were perceived to be the safest assets in the world. This is because it is believed that the US will always be able to repay any kind of loan it takes. This is called debt (http://en.wikipedia.org/wiki/Government_debt. Along with US, debt of countries like Germany, Japan, UK, France etc which are developed and have a sound economy are considered to be safer as well. Hence, China invested a major chunk of its reserves in US debt and a smaller part in these other countries.

Today, China is the largest investor in US debt. This means that China is funding US state expenditures, war expenses, medicare, social security for which US borrows money. Let us analyze the chain reaction now.

(Read "->" as leading to)

China pegs currency artificially low -> China exports cheap goods -> China gets excess dollars->Prints yuan and absorbs excess dollars to maintain the currency peg -> Keeps accumulating US dollars in huge amounts (equivalent to trade surplus) -> Invests in US debt and lends money to US in huge amounts -> Large amount of cheap loan made available to US -> Borrowing cost for US remains very low-> Interest rate in US remains extremely low for an entire decade -> Cheap money causes US corporations and individuals to borrow more and buy more cheap Chinese goods -> AND THE CYCLE CONTINUES

The flow in the picture summarized the explanation above.

Thus by selling more and more cheap goods China is actually encouraging the US to buy even more goods. The results have been extremely negative for US. Firstly, the direct effect was that the manufacturing base in US is almost eroded and it has caused lower GDP growth, unemployment etc. The indirect effect it that the Americans having access to cheap money have been borrowing more money than ever funded by China. Its a classics case of spending more than earning.

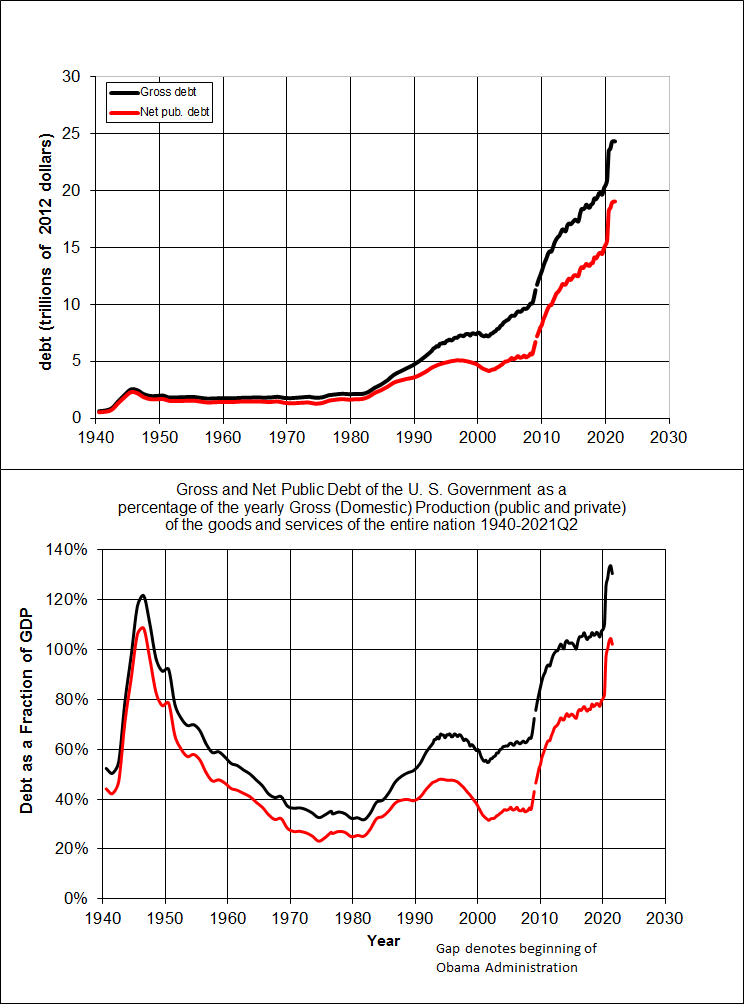

By putting some into play, we will get a direct idea of the consequences. The US debt has risen like an exponential graph and is nearing 100% of its GDP.

(Although not all of this rise can be attributed to this topic. US being involved in a decade long war in Afghanistan, Iraq along with 2008 crisis have significantly contributed to this rise in debt)

At the same time the Chinese foreign reserves have increase in somewhat similar fashion. Can we relate the two graphs? One is where one party is going into huge debt and the other is building a huge reserve at the same time!!

Along with a huge store for shopping, US has found in China a banker who lends enormous amounts and makes borrowing cheaper for US. US is now addicted to this double cushion China is providing. Cheap goods and easy money to buy them. US is getting extremely indebted and China is gaining doubly.

Imagine if China gets hesitant to lend money to US, who else is big enough to fund the US????

Check out this link http://www.defeatthedebt.com/

Check out this link http://www.defeatthedebt.com/